Multi-Billion Dollar Fraud Rocks Insurance Marketplace

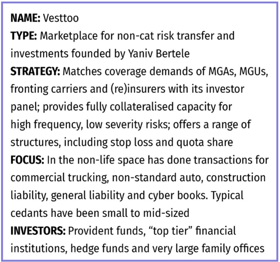

Over the course of the last month, financial fraud was uncovered in the reinsurance industry which is currently estimated at up to $4 Billion. The company responsible for this misconduct is the Israeli Fintech, Vesttoo. Unlike traditional “balance sheet” reinsurers who provide security to downstream insurance partners based on the liquidity and consistency of their balance sheets, Vesttoo focused on an alternative area of capital support known as Insurance-Linked Securities (“ILS”).

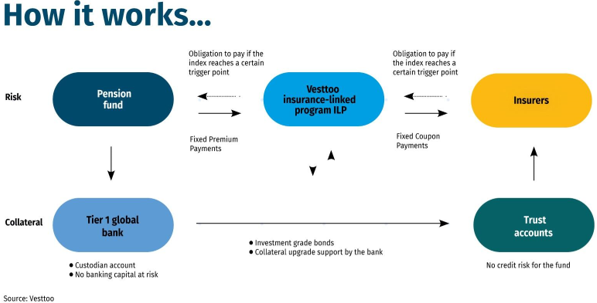

Per their website, Vesttoo uses artificial intelligence technology to connect the insurance industry and capital markets. Simplistically, ILS allows non-rated insurers/investors to participate in reinsuring positions using capital instruments, typically in the form of Letter of Credit(s) (“LOC”). LOCs provide the security and capital that allows insurance carriers to take on certain risk positions which would traditionally be borne by reinsurers. Vesttoo brought together the investors with capital, and the MGA’s and insurers in need of it. Unfortunately, in this case, many of these LOCs were not worth the paper that they were written on, meaning there is no currently known capital to back up to $4 Billion of insurance liabilities.

In this case, the “Tier 1 global bank” was the Construction Bank of China (“CCB”), or so the worthless paper showed. It should be noted that CCB is known as one of the “Big 4” banks of China with 23 Trillion in assets. This is a “state-owned” bank that has heavy operations in the Bermuda banking community and thus was a normal and accredited player in the alternative risk world and thus accepted. Their credibility was not ever an issue in the transaction.

This event is being billed as “Unicover 2.0”. Many will not have the grey hair to remember that event in the 1990s and the aftershocks provided to the general insurance marketplace; especially to my old friends at Reliance. It was the first time I had heard the term “cash-flow suffocation”. Short story (long one here https://www.insuranceobserver.com/PDF/1999/111099.pdf ) is that an underwriting manager (Unicover) was able to convince a consortium of life insurance companies that highly volatile workers’ compensation business was a good bet. Unicover sold a tremendous amount of this reinsurance support to companies that I worked with such as Reliance. Fronting carriers cede all or most of the risk to other supporters (“cedants”) of a given transaction, and this was the traditional position of Reliance. They would be paid a fee to in essence take no risk, but instead provide others the ability to trade with their paper. The support provided was also not traditional, but instead, Occupational Accident Insurance, which was endorsed to act like workers’ compensation and was better understood by the life insurers that supported the positions. They thought.

When the losses started rolling in and the reinsurers saw they had been duped, instead of paying claims, they litigated. Whether they were right or not, this delay in funding for loss to Reliance quickly rendered them insolvent. While on paper they were making great money and had an “A” rating, the amount charged to front the policies was a fraction of the money needed to pay all the claims out in time.

In an article available only to AM Best subscribers on this past July 25th titled; “AM Best to Review Collateral Arrangements at Rated Fronting Insurance Companies”, there is a specific list of fronting carriers under review due to this occurrence. Best remarks “In recent days, Vesttoo, an insuretech that connects capital market participants with (re)insurance risks, has been in the news regarding claims of fraudulent collateral. Although the details and scope of this issue remain unclear, AM Best is monitoring the rapidly evolving situation and reviewing fronting carriers and other insurers that have material amounts of reinsurance counterparty credit risk and reliance on various forms of collateral.” It goes on to state that insurers that cede more than 85% to reinsurance bring upon themselves an elevated level of counter-party credit risk.”[1]

The most recent news is that the intermediary who was part of many of the Vesttoo transactions, Aon, has sued Vesttoo to freeze all accounts for fear of there being no capital for their clients. A segment from the Aon brief that allowed it to freeze all Vesttoo’s assets, with the exception of $1m to pay salaries and other normal business operating expenses:

The docket states, “On information and belief, the fraudulent Vesttoo LOCs could total in the billions of dollars. Given the imminent collapse of Vesttoo expected to flow from this discovery, on information and belief, Vesttoo intends to remove all or substantially all funds from its United States bank accounts and dissipate the funds making them near impossible to recover.”[2]

So what’s next? So far, the removal of the Vesttoo senior executives, freezing of their bank accounts, reduction of staff by 75%, closing of non-Israeli branches, and most importantly, a sprint to get replacement collateral on the deals that require it. All the insurers with the heaviest exposure in this debacle are issuing statements of replacing this security with others and downplaying the impact of this event. There is no question this will impact market capacity, especially with those MGA/MGU/FinTech entities that relied on Vesttoo and the ILS market in general to provide support for their programs. We are hopeful this misconduct does not impact the solvency of friends and partners in the space and will continue to report events as newsworthy.

*As of today, Israeli insurance startup Vesttoo Ltd. filed bankruptcy after an Aon Plc subsidiary accused the company of presenting fraudulent letters of credit and a federal judge froze its assets. Continue reading on PropertyCasualty360 to get the full story.

[1] AM Best Commentary, July 25, 2023, “AM Best to Review Collateral Arrangements at Rated Fronting Insurance Companies”

[2] https://www.artemis.bm/news/aons-white-rock-pursues-vesttoo-in-court-gets-order-to-freeze-assets/

Join the Conversation on Linkedin | About PEO Compass

The PEO Compass is a friendly convergence of professionals and friends in the PEO industry sharing insights, ideas and intelligence to make us all better.

All writers specialize in Professional Employer Organization (PEO) business services such as Workers Compensation, Mergers & Acquisitions, Data Management, Employment Practices Liability (EPLI), Cyber Liability Insurance, Health Insurance, Occupational Accident Insurance, Business Insurance, Client Company, Casualty Insurance, Disability Insurance and more.

To contact a PEO expert, please visit Libertate Insurance Services, LLC and RiskMD.