Workers' Compensation Insurance Outperforms all Casualty Lines

Workers' Compensation Insurance

So awesome to see everyone at #NAPEO this past week. What a spectacular collection of friends and family!

For the third straight year, the combined ratio for workers' compensation has hovered in the mid-80's. This means insurance companies are making +30% ROI on the line, which is historically rarified air. These results have no historic precedent, and with plenty of carrier surplus on the shelf, rates are going to severely drop again going into 2022. While there is still talk of a spike based on COVID "long-haulers", the initial estimates of COVID impact on workers' compensation were not even close, and thus the speculation that this will increase, is, at least at present, noise. I would make sure you know what your rate sets look like going into this 1/1 as it should be a very dynamic session with some states like Oklahoma are already dropping rates close to double digits https://news.ambest.com/newscontent.aspx?refnum=236530 . Expect 6-8 down across the board for policies with a 1/1 inception, in those states that change rates/loss costs on 1/1.

Beware of the other casualty lines, especially EPLI and cyber. Both are taking severe losses with no end in sight. EEOC claims are up exponentially due to vaccination mandate. The average ransom fee requested has increased from $5,000 in 2018 to around $200,000 in 2020. (National Security Institute, 2021). We are seeing most everything up on these lines, with heavy pressure to also increase retentions. If you do not know what MFA is, you better find out https://www.youtube.com/watch?v=tFv101qURKE . Without it, you are deemed uninsurable.

Foremost, be safe and have a great weekend.

Next week, check on your workers' compensation pricing as you may need some budget to address the other two lions at the gate - EPLI and cyber.

From our friends at the Insurance Journal...

September 30, 2021

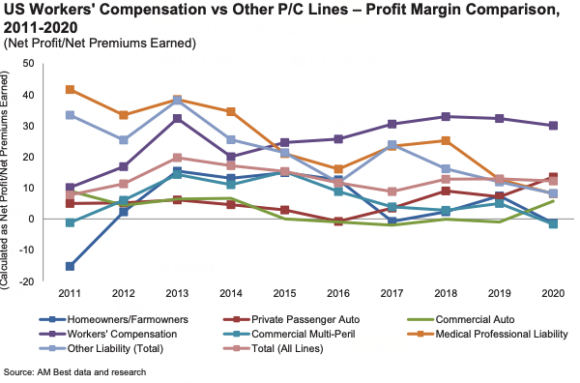

Workers’ compensation underwriters have been consistently generating better underwriting profits than other property/casualty lines of business, and did so again in 2020 amid the pandemic.

According to an AM Best report, underwriting results of workers’ compensation insurers remained strong in 2020, despite a 10% decline in bottom-line net premiums written, which was due to a substantial drop in payrolls during the second quarter of the year. The hospitality and service industries suffered considerably, driving the NPW decline.

The segment’s combined ratio of 91.1 was a few points higher than in 2019 (88.5), but still reflected profitable underwriting. Homeowners multiple peril, by contrast, booked a 107.4 combined ratio in 2020, private passenger auto had a 92.5 combined ratio and commercial auto was at 101.9. The workers comp combined ratio also won out when compared to the P/C industry combined ratio overall.

Expense ratios rose given the decline in premium, but AM Best said the increase was “nominal and did not overly dampen underwriting earnings.”

Premium volume for workers’ compensation writers also has been constrained by rate decreases in most states. According to the report, some writers are looking to develop new products and explore new markets in other lines of coverage and allowing their workers’ compensation top-line premium to decline in the states where they generate significant premium.

Despite the smaller premium base, workers’ compensation insurers remained highly profitable in comparison with other P/C lines. Workers’ compensation underwriters have benefited from a decline in lost-time claims frequency tied to efforts to improve workplace safety. Other factors that have benefited the line’s profitability are declines in fraud, workplace accidents and defense costs.

Lessons from the Pandemic for Workers’ Compensation

Workers’ Compensation Numbers Indicate Strong Performance During 2020 Pandemic

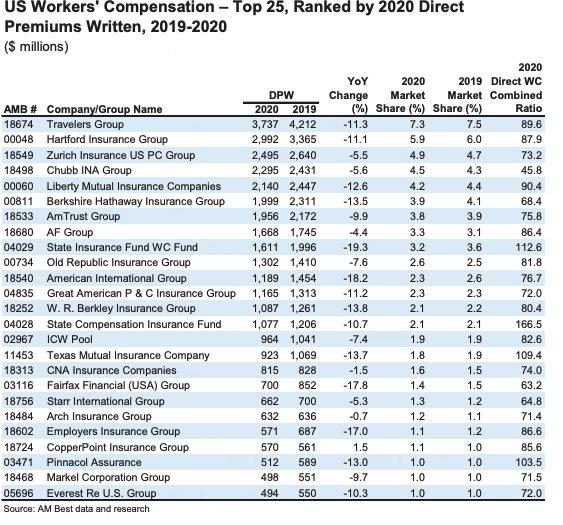

AM Best also analyzes the business through its Workers’ Compensation Composite, which is composed of U.S. companies, including state funds, whose workers’ compensation and excess workers’ compensation net premiums constitute 50% or more of their total net premiums. Even with the 2020 decline in workers’ compensation premium due to the pandemic, the market share of these specialists rose to 26.2% in 2020, up considerably from 16.7% in 2011.

According to the report, 24 of the top 25 workers’ compensation writers had their premium decline in 2020, with a number seeing double-digit premium declines.

Despite all the good news from 2020, AM Best has a negative market segment outlook for the workers’ compensation segment, the largest component of the U.S. commercial lines market,. The outlook reflects the “continued uncertainty about the effects of COVID-19, from an economic and a regulatory perspective, as well as a legislative one as states consider presumptive legislation stemming from the pandemic,” the ratings agency said.

AM Best said it also has concerns about the prolonged low interest rate environment. As a result, investment returns are expected to remain flat, and insurers may begin seeking riskier investments to generate higher yield, the firm said.

Source: Best’s Market Segment Report: Workers’ Compensation Still Outpacing Other Lines

Join the Conversation on Linkedin | About PEO Compass

Contact Professional Employer Organization (PEO) Expert, Paul Hughes

Paul Hughes has been working with the Professional Employer Organization (“PEO”) industry since 1995 and data management since 2005. He is responsible for the day to day operations of both Libertate Insurance Services, LLC and RiskMD, which reports into the overall Ballator Insurance Group family of companies. Learn more about Paul.

Specializing in PEO Services: Workers Compensation, Mergers & Acquisitions, Data Management, Insurance Focus on: Employment Practices Liability (EPLI), Cyber Liability, Health Insurance, Occupational Accident, Business Insurance, Client Company, Casualty, and Disability Insurance.