The Future of Artificial Intelligence in the Insurance Industry

AI is poised to reshape the insurance industry in several key areas, offering both opportunities for growth and potentially treacherous challenges.

Using a few of our favorite recent articles on the subject, we’ve put together a road map of just how much potential AI has to shift the future of Insurance.

AI-Driven Risk Management and Personalized Policies

One of the most significant opportunities AI offers insurers is in the realm of risk management and personalized policy offerings. By leveraging AI, insurers can utilize larger-than-ever datasets to predict risks with a level of precision previously unattainable. This enhanced risk assessment can enable insurers to offer highly personalized policies, tailored to the specific needs and risk profiles of individual customers. For instance, AI could allow insurers to adjust premiums in real time based on a customer’s behavior, such as driving habits or health metrics.

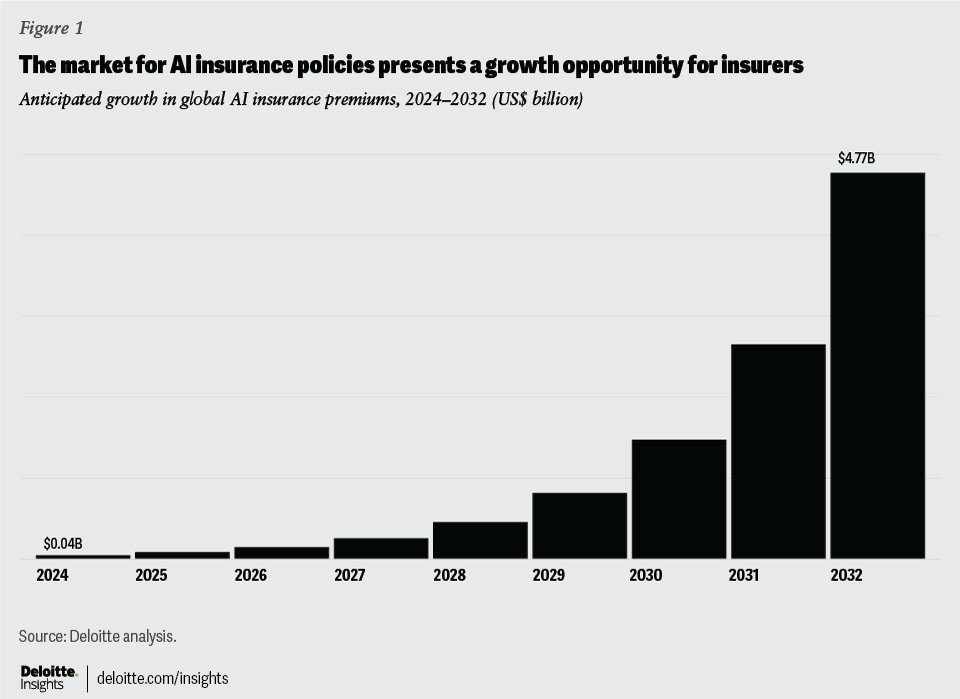

However, this technological change also introduces new risks to manage. AI systems are not immune to the occasional slip up or biased outcome, which could lead to disputes over claims or regulatory scrutiny. As noted in a recent article as a part of Deloitte’s FSI Predictions 2024, there is a growing need for insurance products that cover the risks associated with AI itself. Insurers who move quickly to develop such products could establish themselves as leaders in this emerging area, but they must balance innovation with careful risk management (view the full article here). Should the growth of AI policies grow anywhere close to Deloitte’s prediction below, insurers must begin to prep for the coming changes.

Balancing Investment with ROI

The potential of AI in insurance is vast, but realizing that potential requires significant investment. According to a recent article from Goldman Sachs, there is a concern that the current level of spending on AI may not be matched by the benefits it delivers, at least not in the short term. For insurers, this means that AI investments need to be carefully targeted.

Investing in AI should be seen as a long-term strategy, where the benefits may not be immediately apparent but could result in substantial gains over time. This might include investments in areas such as claims processing automation, which could reduce operational costs, or in developing tools for fraud detection, which could prevent significant financial losses. However, insurers must avoid the trap of over-investing in AI projects that lack a clear path to profitability. Careful prioritization of AI initiatives is essential to ensure that resources are allocated to areas with the highest potential ROI (view the full article here). Even with the seemingly ubiquitous hype in media and popular culture over AI in recent months, businesses must ensure their long-term strategies are strategic, not speculative.

Investor Skepticism and the Long-Term View

Investor sentiment around AI, particularly in industries like insurance, is increasingly cautious. Despite the frenzy surrounding AI, there is skepticism about when, or if, these investments will start to generate significant financial returns. This skepticism is particularly pronounced on Wall Street, where investors (per a recent CNN article) are beginning to demand more evidence of AI’s profitability.

For insurance companies, this means they need to be prepared to demonstrate the value of their AI investments to both investors and customers. This could involve showcasing successful AI implementations, such as reduced claims processing times or improved customer satisfaction scores. At the same time, insurers should manage expectations by emphasizing that AI is a long-term investment, and that while the benefits may take time to materialize, they have the potential to fundamentally transform the industry.

The Path Forward for Insurers

Given these challenges and opportunities, what steps should insurers take to ensure they are leveraging AI effectively?

Focus on Targeted AI Investments: Rather than spreading resources thinly across numerous AI initiatives, insurers should focus on a few key areas where AI can have the most impact. For example, AI-driven underwriting could significantly improve risk assessment, while AI in customer service could enhance the customer experience and reduce costs.

Develop AI-Centric Insurance Products: As businesses increasingly adopt AI, there will be a growing need for insurance products that cover AI-related risks. Insurers who can develop innovative products in this space, such as coverage for AI-driven decision-making errors or cyber risks associated with AI, will be well-positioned to capture new market opportunities.

Maintain a Long-Term Perspective: AI’s full impact on the insurance industry will likely unfold over years, not months. Insurers need to maintain a long-term perspective, balancing the need to innovate with the need to deliver short-term results. This might involve setting realistic expectations with investors and stakeholders about the timeline for AI-driven returns.

AI represents a significant opportunity for the insurance industry, but realizing its potential will require careful strategy, targeted investments, and a willingness to navigate the challenges that come with adopting new technology. By focusing on areas where AI can deliver the most value, developing new products to address emerging risks, and maintaining a long-term perspective, insurers can position themselves for success in an increasingly AI-driven world.

Author: PJ Hughes

Click below to view the sources for this article:

Deloitte: Providing insurance coverage for artificial intelligence may be a blue ocean opportunity

Goldman: GEN AI: TOO MUCH SPEND, TOO LITTLE BENEFIT?

Join the Conversation on Linkedin | About PEO Compass

The PEO Compass is a friendly convergence of professionals and friends in the PEO industry sharing insights, ideas and intelligence to make us all better.

All writers specialize in Professional Employer Organization (PEO) business services such as Workers Compensation, Mergers & Acquisitions, Data Management, Employment Practices Liability (EPLI), Cyber Liability Insurance, Health Insurance, Occupational Accident Insurance, Business Insurance, Client Company, Casualty Insurance, Disability Insurance and more.

To contact a PEO expert, please visit Libertate Insurance Services, LLC and RiskMD.

#PEOUnderwriting#propertycasualtyAI#technologymachine learning #PEO