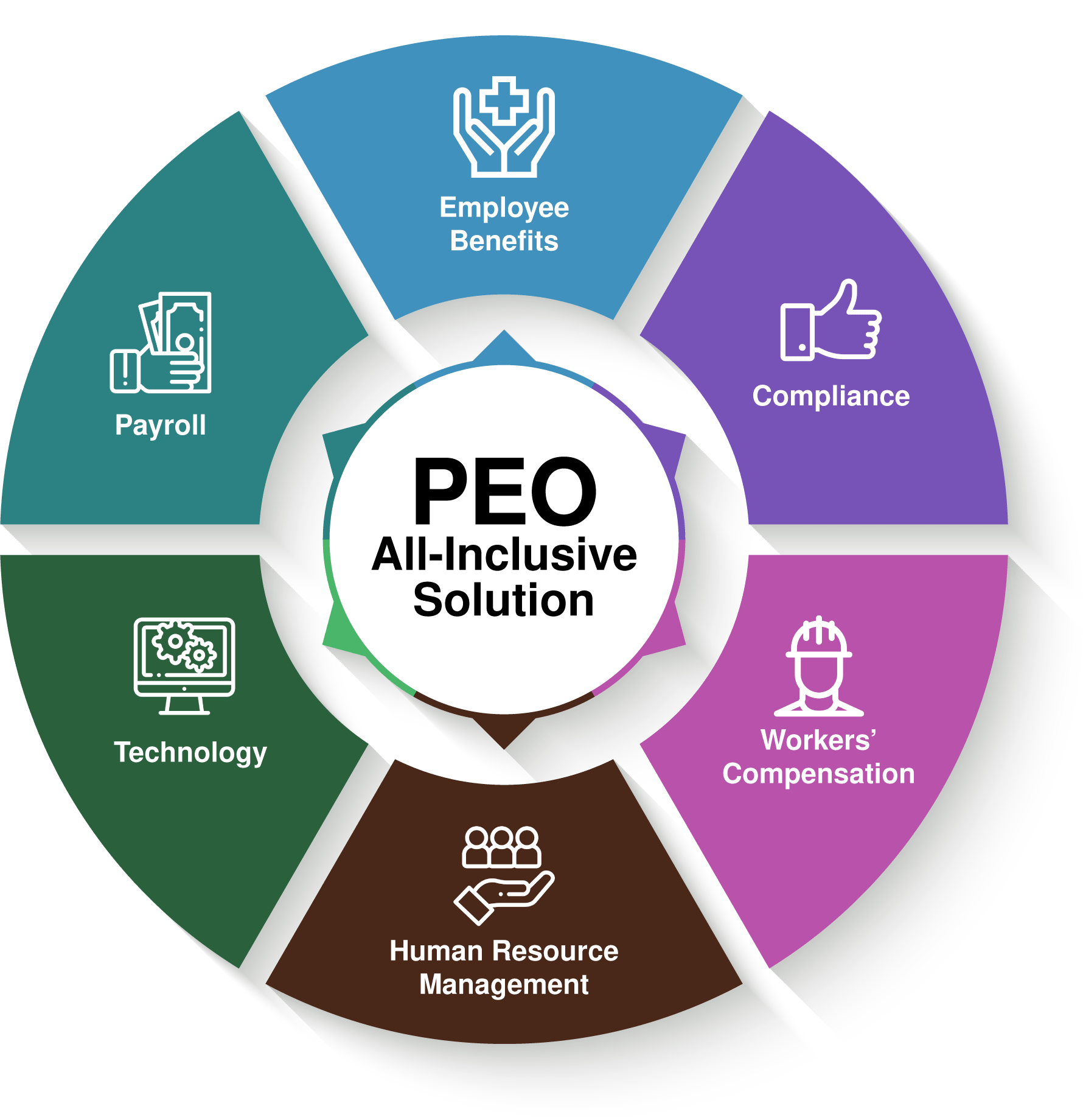

Should You Partner with A PEO? Can a PEO help your small business?

How a PEO Can Help Your Small Business

Understand the Importance of What PEOs are Doing for Their Clients; Consider what a PEO can offer your small business; Having a business relationship that benefits you!Check out the article below to see how PEOs work to protect small business clients_____________________________________________________________________

THE EXPANDING PEO WHEELHOUSE: HELPING SMALL BUSINESSES SURVIVE

COVID-19: STORIES OF ADAPTATION: HOW SERVICE & DELIVERY CHANGEDBY KATHRINA SALADRIGASEighteen weeks have passed since we sent our first COVID-19 newsletter to Regis HR Group clients. Looking back, we could not have anticipated the scope of support our clients would need. In addition to inquiries about traditional human resources matters, we received an unprecedented number of questions about general business operations from employers, to the point of, “What can we do to survive?”PEOs are uniquely positioned to help our local economies (and the country as a whole) recover from the pandemic, so here are some of things we hope all PEOs will implement to help their worksite employers overcome the challenges of the COVID-19 pandemic.

EMPLOYERS DESERVE A BETTER ANSWER THAN ‘THAT’S NOT WHAT WE DO’

Laws such as the Coronavirus Aid, Relief, and Economic Security (CARES) Act and the Families First Coronavirus Response Act(FFCRA) are being passed and subsequently changed at an extraordinary rate, so employers are reasonably overwhelmed:

- What government-sponsored financial relief is available to our business?

- How do layoffs and furloughs affect health benefits?

- Is our business an “essential” business?

- Who is eligible for sick leave under the FFCRA?

- Do we have to close our facility if an employee tests positive? If yes, for how long?

This is a very small sample of the questions creating uncertainty and anxiety for business owners. While some of these questions are business-specific and can only be addressed by the employer’s legal counsel and/or tax professional, there are practical steps PEOs can take to support these employers without defaulting to “that’s not what we do:”

- We’ve learned that monitoring regulatory changes and providing brief descriptions (one to three sentences) with links to the governing body in a timely fashion reassures clients that they have a trusted partner to lean on and reduces worries about missing something.

- Similarly, sharing a finite list of well-researched government resources that consolidate information from multiple regulatory bodies (such as the Centers for Disease Control and Prevention (CDC) Resuming Business Toolkit) saves employers time and reduces the incidence of misinformation.

- We’ve learned that employers appreciate live interactive webinars where they can connect with employment lawyers and tax professionals. To this end, Regis HR Group has sponsored eight webinars (at no charge to PEO clients) with topics ranging from FFCRA requirements to Payroll Protection Program (PPP) loan forgiveness, with additional webinars scheduled in the upcoming weeks.

- Perhaps most importantly, we’ve witnessed the significance of the human connection (albeit socially distanced). Our entire team, from our payroll specialists to our president, has proactively worked to check in with our clients and ask, “How can we help?” Often, the answer is not something in our traditional scope of services, but we’re committed to do what we can.

HELPING EMPLOYERS ADJUST TO THE ‘NEW WORKPLACE’

The pandemic has created a seismic shift in our traditional workspace. Whether or not this shift is temporary remains to be seen. In the meantime, however, employers are finding it difficult to adjust to the new workplace.To help mitigate the stress that accompanies these significant changes, we have provided several tools to educate employers and their managers about how to get the most out of their employees in remote work environments, how to maintain employee morale, and how to continue to communicate effectively as a team.Some employers find themselves in a position to reopen, but their pre-pandemic staff is refusing to return. We are helping these employers find qualified staff, often by connecting them with employees who have been laid off by other clients.For clients that are hiring during this ordeal, we are sharing resources on interviewing best practices and, in particular, educating them about the importance of behavioral interview questions.While it has long been commonplace to ask behavioral interview questions to assess a candidate’s problem-solving skills, resiliency, and adaptability in demanding/high-stress work environments (such as healthcare, investment banking, and hospitality), the pandemic has demonstrated that these skills are central to the success of every business.To that end, PEOs should be encouraging employers to ask behavioral interview questions, in addition to assessing candidates on previous experience—because past behaviors can help predict future performance. Examples of behavioral questions include:

- “Tell me about a chaotic situation you experienced in a professional setting.”

- “Describe a time that, despite your best efforts, things did not work out as you had envisioned.”

FACILITATING REPORTS FOR PPP FINANCING & MEANINGFUL BUSINESS CONNECTIONS

Lenders participating in the Payroll Protection Program, which helped businesses across the United States maintain their workforces during the COVID-19 crisis, required employers to submit payroll reports quickly and accurately.In addition to producing detailed payroll reports that included employee salaries, wages, commissions, cash tips, group health benefits payments, retirement benefits payments, state or local taxes, etc., Regis HR Group was able to help small businesses connect with local, community banks participating in the Small Business Administration’s PPP loan program.Our clients thanked us for these introductions because community bankers were often more helpful with questions about PPP loans and more responsive than their counterparts working for national banks. Similarly, the community banks were thankful for the introductions because, prior to the pandemic, many of these employers had not considered partnering with a local bank for their routine banking and financing needs.

WE ARE IN THIS TOGETHER

COVID-19 remains a clear and present danger, but we are confident that working together, our country will overcome this crisis. We are motived by the dedication of our team and inspired to work harder each day to earn the gratitude of our clients.Moving forward with the support of PEOs across the nation, we can serve our clients in new ways and emerge stronger from this pandemic.KATHRINA SALADRIGASMarketing & Talent Acquisition DirectorRegis HR GroupMiami, Florida

Join the Conversation on Linkedin | About PEO Compass

The PEO Compass is a friendly convergence of professionals and friends in the PEO industry sharing insights, ideas and intelligence to make us all better.All writers specialize in Professional Employer Organization (PEO) business services such as Workers Compensation, Mergers & Acquisitions, Data Management, Employment Practices Liability (EPLI), Cyber Liability Insurance, Health Insurance, Occupational Accident Insurance, Business Insurance, Client Company, Casualty Insurance, Disability Insurance and more.To contact a PEO expert, please visit Libertate Insurance Services, LLC and RiskMD.