THE PEO PERISCOPE: A Look Under the Insurance Market (PEO Insider)

By Paul Hughes, Principal | Libertate Insurance LLC, Orlando, FL

“In an effort to keep our PEO family up to speed with insurance market conditions on what impacts them most, PEO Compass has partnered with MarketScout from a data standpoint, and the PEO Insider to organize a quarterly report called The PEOriscope. Below is the April edition with a new on anticipated in July.”

Best – Paul

Download the article by Paul in PEO Insider Magazine.

By utilizing the most current and credible information available, Insurance Trends provides quarterly feedback and insights on the insurance industry and its impact on the PEO community. It provides current analysis and futuristic expectations on the terms and conditions that should be anticipated for property and casualty lines of business insurance that impact a PEO and its client companies.

2023 OUTLOOK

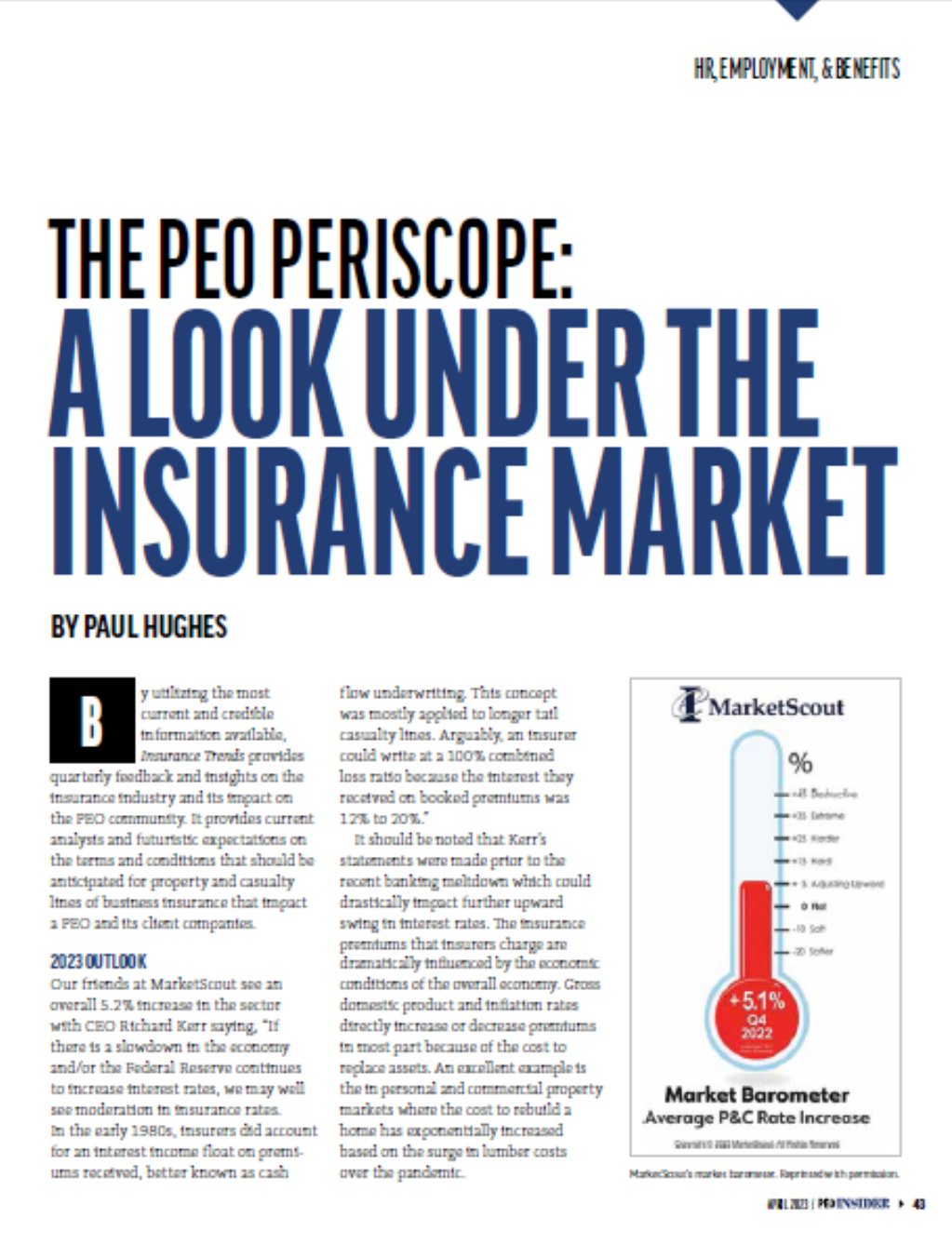

Our friends at MarketScout see an overall 5.2% increase in the sector with CEO Richard Kerr saying, “If there is a slowdown in the economy and/or the Federal Reserve continues to increase interest rates, we may well see moderation in insurance rates. In the early 1980s, insurers did account for an interest income float on premiums received, better known as cash flow underwriting. This concept was mostly applied to longer tail casualty lines. Arguably, an insurer could write at a 100% combined loss ratio because the interest they received on booked premiums was 12% to 20%.”

It should be noted that Kerr’s statements were made prior to the recent banking meltdown which could drastically impact further upward swing in interest rates. The insurance premiums that insurers charge are dramatically influenced by the economic conditions of the overall economy. Gross domestic product and inflation rates directly increase or decrease premiums in most part because of the cost to replace assets. An excellent example is the in personal and commercial property markets where the cost to rebuild a home has exponentially increased based on the surge in lumber costs over the pandemic.

Inflation rates 2009 - 2024

Inflation rates and the Consumer Price Index are two core drivers of insurance rates. As the price of goods increases due to inflation, such as the cost to build, there is more value to insure and replace, and thus higher premiums to be charged. 2021 and 2022 inflationary results were both anomalies when considering the last 15 years of activity. Specifically, the rate was never above 3.2% going back to 2009 but hit 4.7% and 8% respectively in 2021 and 2022. While the expectation at this time was for the rates to taper off based on an increase in the Fed rates, the recent banking crisis, is now a very big unknown as to what the Federal Reserve decreased in 2023, all lines should expect a 5% upward trend without considering individual performance. Double-digit increases and an extreme variance in terms and conditions will drive cyber and EPLI and umbrella layers in the higher limits. In storm-prone areas such as the southeast and California, property rate increases will be extreme, and deductibles continue to push upward.

Join the Conversation on Linkedin | About PEO Compass

The PEO Compass is a friendly convergence of professionals and friends in the PEO industry sharing insights, ideas and intelligence to make us all better.

All writers specialize in Professional Employer Organization (PEO) business services such as Workers Compensation, Mergers & Acquisitions, Data Management, Employment Practices Liability (EPLI), Cyber Liability Insurance, Health Insurance, Occupational Accident Insurance, Business Insurance, Client Company, Casualty Insurance, Disability Insurance and more.

To contact a PEO expert, please visit Libertate Insurance Services, LLC and RiskMD.